Hello and welcome! Today we are talking about Form 2553, Election by a Small Business Corporation. In this video, we dive into why you would want to become an S-corporation, who should file Form 2553, and when you should file Form 2553. Now, most corporations are considered a C-corporation by default. But many corporations are eligible to file Form 2553 to become an S-corporation. In order to qualify, companies must fulfill certain criteria and follow specific processes. So let's take a look. Tip #1 - Why become an S-Corporation? It's important to understand why a corporation would want to become an S-corporation. Small companies typically elect to become S-corporations so that their net taxable income is taxed to the shareholders rather than the corporation itself. This means that the small company can pass its income, credits, deductions, and losses onto the shareholders for tax purposes. Income is then reported on the shareholders' personal returns and taxed at their personal tax rates, and not subject to any corporate taxes. C-corporations, on the other hand, run the risk of being taxed twice - both at the corporate and shareholder level when dividends are paid out. Tip #2 - Who should file Form 2553? With all the clear benefits, why doesn't everyone elect to become an S-corporation? Unfortunately, not all small businesses can qualify for an S-corp election. In order to be eligible to be considered as an S-corp, a business must meet the following requirements: The corporation must be domestic. This means that they must do most, if not all, of their work within the United States. The Form 2553 has to be filed on time. The corporation can have no more than 100 shareholders. The corporation, or eligible entity, can have only one class of stock. And the corporation cannot have...

Award-winning PDF software

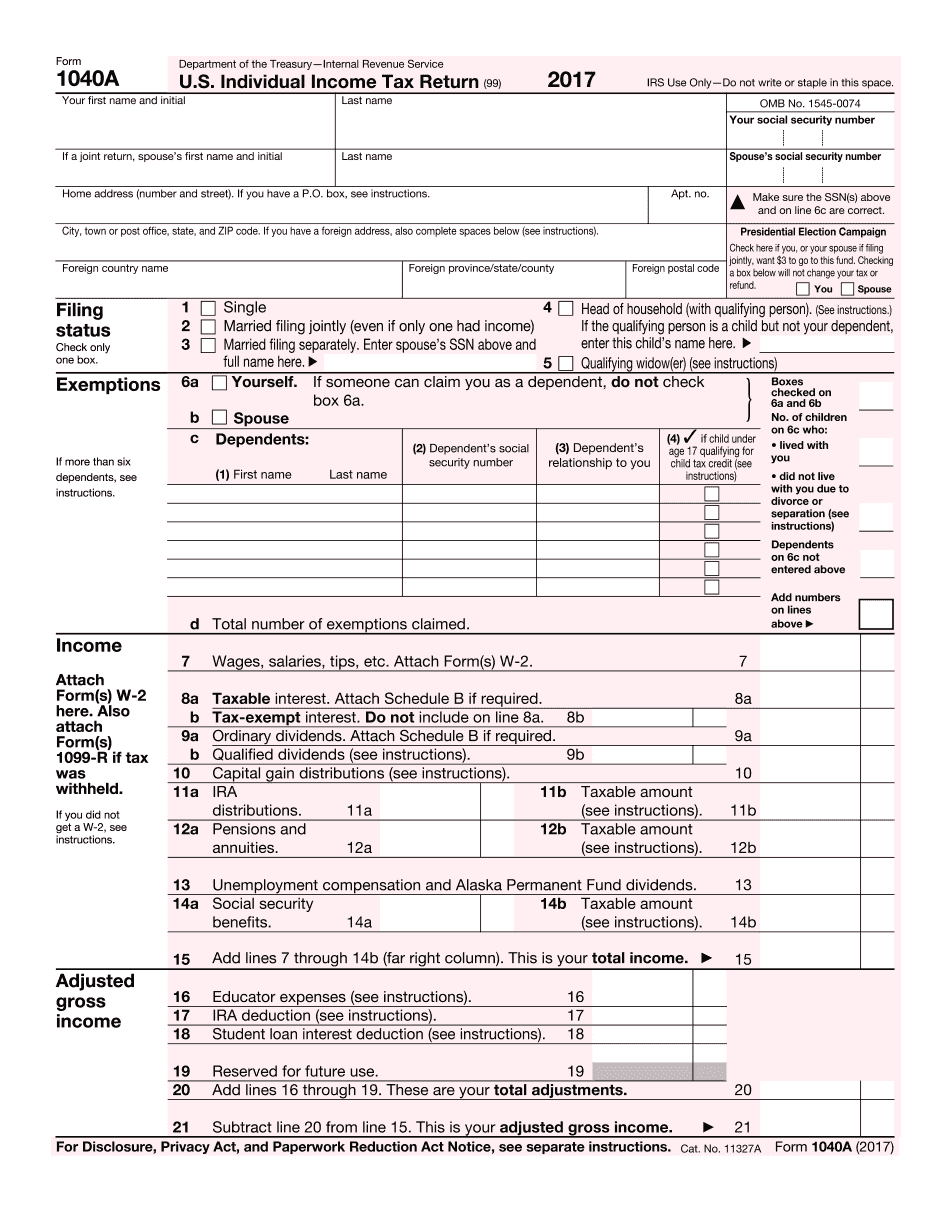

What is IRS 1040a Form: What You Should Know

Dec 25, 2025 — You should be a yes if you have been terminated in the last 12 calendar months (or at any time during the last five years at the discretion of the agency) for one or more of the following reasons: — For any reason ‹ you are told you ‹ may be terminated for one or more reasons (this is known as a “termination for cause”) — For cause ‹ a termination, which includes any actions taken pursuant to an order or order issued by your employer, or pursuant to the terms and conditions of your employment agreements, including termination for cause. — For Cause — An intentional act, such as an intentional misconduct or intentional violation of applicable laws, policies or regulations. — For Cause — The act or omission that caused a termination, including for cause, misconduct or violations against the legal or moral rights of another. — For Cause — Your violation of or failure to comply with a written contract. — A termination for cause, whether intentional or unintentional. — A termination that was the result of a breach of your employment agreement. — A termination for cause, whether intentional or unintentional. — A termination that was the result of unforeseeable events beyond your control. — A termination for cause ‹ as determined by a neutral and detached administrator. — A termination for cause ‹ as determined by a neutral and detached administrator. — A termination for cause ‹ by a neutral and detached administrator. — An intentional act that caused a termination (i.e., intentional misconduct or intentional violations of applicable laws, policies or regulations). — For this reason, if you were terminated for cause, you may wish to re-apply for a new position.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form What is IRS 1040a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form What is IRS 1040a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form What is IRS 1040a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form What is IRS 1040a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form What is IRS 1040a