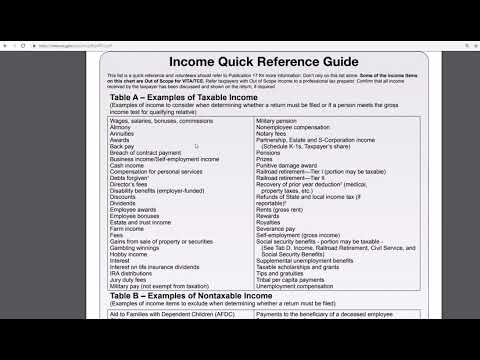

Good morning, everyone. This is Med City CPA, and I'm reading through the IRS publications to get ready for the tax season. Currently, I'm on Publication 1 2 December revisions of December 2018. I found a quick reference guide in this publication that provides examples of taxable income. This guide is extracted from Publication 17, but it serves as a convenient summary. I decided to make a video about it because there are many examples of taxable income that people often overlook. It's quite interesting to explore these less common sources of taxable income, such as discounts, employee awards, fees, hobby income, jury duty fees, tribal per capita payments, and more. These examples offer unique insights into tax laws. Additionally, Table B in the publication presents examples of non-taxable income, including child support, gifts, and Olympic and Paralympic Games medals and prizes. It's essential to carefully read through all the instructions provided to fully understand these exceptions. I came across this quick reference guide on page 59 of Publication 4012. I will include a link to it in the description below.

Award-winning PDF software

1040a 2025 PDF Form: What You Should Know

The IRS will send you a link to the PDF document. This is A Form to File Your IRS Tax Return to the United States for Federal Income Tax or Federal Excise Taxes on Over 600,000 Earnings Tax Tip Go to IRS.gov and and get the 2025 Federal Tax Filing Requirements for Single Filers Tax Tip #2 If you use a tax software or prepare tax payments, you should download an electronic tax return for a free download. It makes your life a lot easier. You don't have to go back to the IRS for each individual tax payment. 2018 Tax Forms and Calculators; Estimate your Return Now Get Your Tax Forms | Usage Tax Tip Go to IRS.gov and and get the 2025 Federal Tax Filing Requirements for Single Filers Tax Tip #3 If you use a tax software or prepare tax payments, you should download an electronic tax return for a free download. It makes your life a lot easier. You don't have to go back to the IRS for each individual tax payment. Tax Tip #4 If you use a tax software, prepare tax payments, or file your returns online, download and print your tax forms and the tax return or paper form to carry on your tax activities. Tax Tip #5 If you use a tax software, prepare tax payments, or file your returns online, please download your tax forms and the tax return or paper form to carry on your tax activities. Don't have access to a printer? Order from the link below. Tax Tip #6 Download your 2 Schedule A (PDF). (You can print it on Letterhead, A4 or Letter. (3.5 × 8 inches). Tax Tip #7 If you use a tax software, prepare tax payments, file your returns or paper forms online, print your tax forms from the IRS site and upload them to File-To-File (FTF) or print your tax forms and the tax return or paper form to bring with you to a business or business location that provides ready-to-file services.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form What is IRS 1040a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form What is IRS 1040a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form What is IRS 1040a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form What is IRS 1040a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1040a Form 2025 PDF