Award-winning PDF software

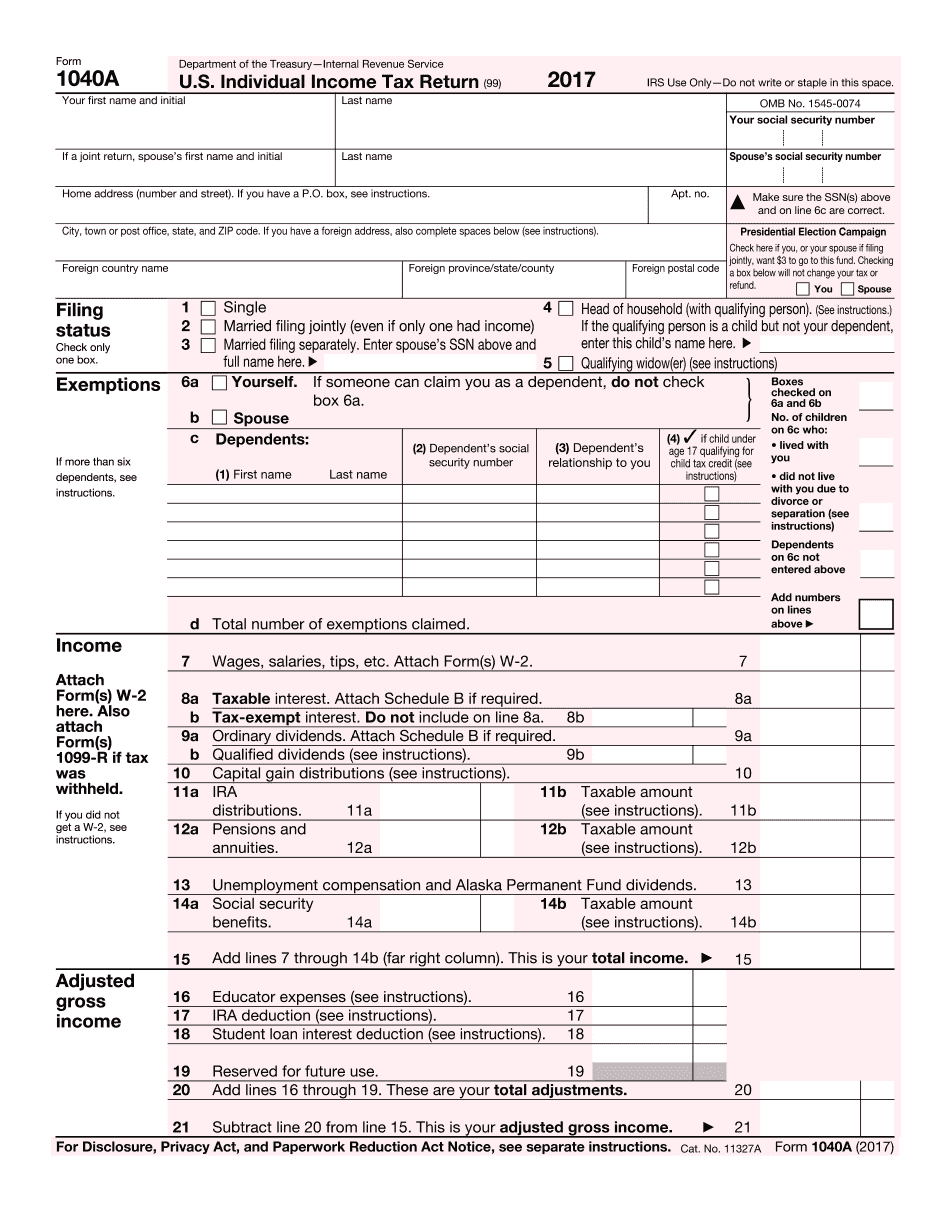

Form What is IRS 1040a Dayton Ohio: What You Should Know

You can click any name to jump or scroll through that name's information. And click the image to read more about that individual or joint filer. Here is a link to our state individual tax form database. You can also view the tax forms filed with Dayton Ohio and see how much the IRS has collected. The database is currently open to people around the world, to allow access from all over the world. The database is a Google Spreadsheet and has a file extension of XLSX and a file format of XLS. The spreadsheet is available as a link on the Dayton Ohio's website and the list of people on that site is also available in Google's search. The Dayton Income Tax Calculator is an Excel workbook that is used to estimate the income tax paid in Dayton Ohio for a particular tax year (or both years) based on your tax filing circumstances. The Dayton Income Tax Calculator is intended to be used when filing your taxes. The Dayton Income Tax Calculator results are not official and must be used for informational purposes only. The calculation process is based on what the IRS requires. You are able to change the assumptions and use a tax software program. See the link on the right to read more about the Dayton Income Tax Calculator, which is provided free of charge. It is available as a link on the Dayton Ohio's website. You can find the link on the Google spreadsheet database. This link takes you to a Google Spreadsheet that you can download and use on your computer. If you want to use the spreadsheet data as a backup for your tax year, you will need to open the file in Microsoft Excel or Google Sheets. Note: This is also the address for the Dayton Income Tax Calculator. It is not the same as the link above, which takes you to the Excel file. This link redirects you to the Google Spreadsheet that you downloaded in the previous step. Here are some of the assumptions we use in our tax calculation: We assume the following: No filing status No self-employment No Roth IRA No health (medical, dental, vision, etc.) insurance No tax bracket No estate or gift tax We assume that everyone in the household will report their income on Schedule A as personal income. We do not tax capital gains or dividend income. If you are a high or high-income family, we recommend you add exemptions such as the following: You are an unmarried head or spouse.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form What is IRS 1040a Dayton Ohio, keep away from glitches and furnish it inside a timely method:

How to complete a Form What is IRS 1040a Dayton Ohio?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form What is IRS 1040a Dayton Ohio aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form What is IRS 1040a Dayton Ohio from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.