Award-winning PDF software

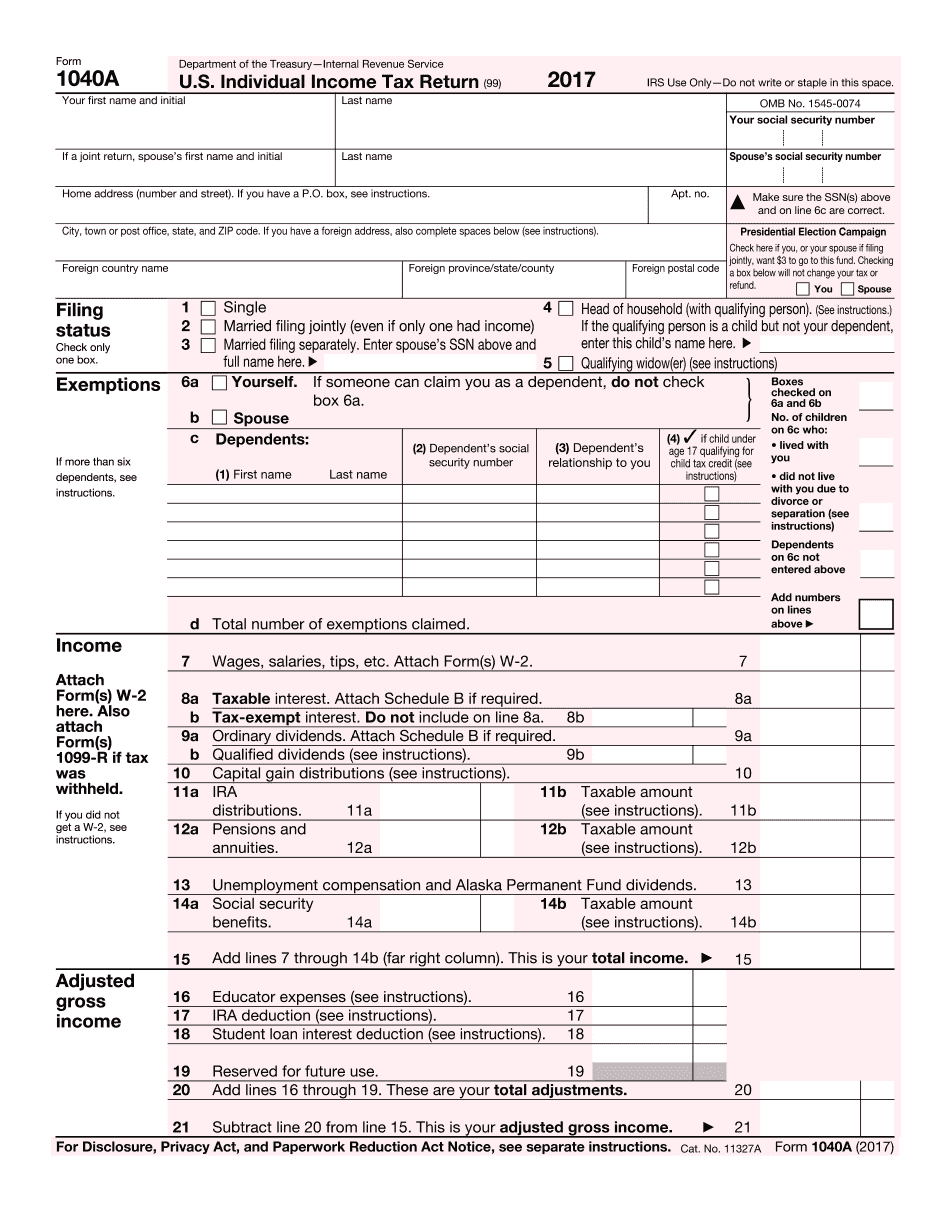

Form What is IRS 1040a online Tucson Arizona: What You Should Know

Forms10332Bingo License Application Forms71-1009Bingo Verification Forming Forms10334Bingo License Registration Form 71-1009Bingo Verification, Certificate of Registration, and Certificate of Registration by Mail Forms10336Bingo License Certificate Forms 71-1009Bingo Verification Forming Forms10337Bingo License Registration Form 71-1009Bingo Verification, Certification of Registration, and Certificate of Registration by Mail Forms10339Bingo License Certificate Forms 71-1009Bingo Verification Forming Forms10342Bingo License Verification and Registration Forming and Processing Forms10343Bingo Application Process Begins Picketing in Arizona, Form 70610341Bingo Application Process Begins Picking, Picking with Determination of Qualification (GQ) Forms10342Bingo Application Process Begins Picking, Picking with Determination of Residency (GDR) Tax Credits & Benefits Arizona — Where to File Tax What is a credit? A credit is a reduction or elimination, in whole or in part, of the tax due. The tax that is eliminated is not refunded, but the tax in which the credit exists is refunded. Arizona requires that businesses provide Form W-2 and pay estimated taxes to the Arizona business credit program. To receive the credit for state income taxes, employers provide an employee's Form W-2 to the Department of Workforce Solutions. The Department of Workforce Solutions then issues a W-2EZ claiming the amount of the employee's federal income tax withheld on wages for employees working in Arizona. Forms & Instructions | IRS TAX TIP 2001-22 WHICH FORM WILL I USE FOR PAYMENT OF EXPENSES AND SALES TAXES? The simplest Form W-2EZ will be issued when state income taxes are withheld. Forms & Instructions | Internal Revenue Service Arizona — Where to File Addresses for Taxpayers and Tax Jul 29, 2025 — Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns to Arizona. Forms & Instructions | IRS TAX TIP 2001-22 WHICH FORM MAY INCLUDE AN ADDITIONAL REQUIRED CONTACT INFORMATION? Form W-2 is required to be issued by the IRS when the taxpayer has a business location in Arizona. Forms W-2EZ are issued for purchases or sales or other business transactions by taxpayers outside Arizona.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form What is IRS 1040a online Tucson Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form What is IRS 1040a online Tucson Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form What is IRS 1040a online Tucson Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form What is IRS 1040a online Tucson Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.