Award-winning PDF software

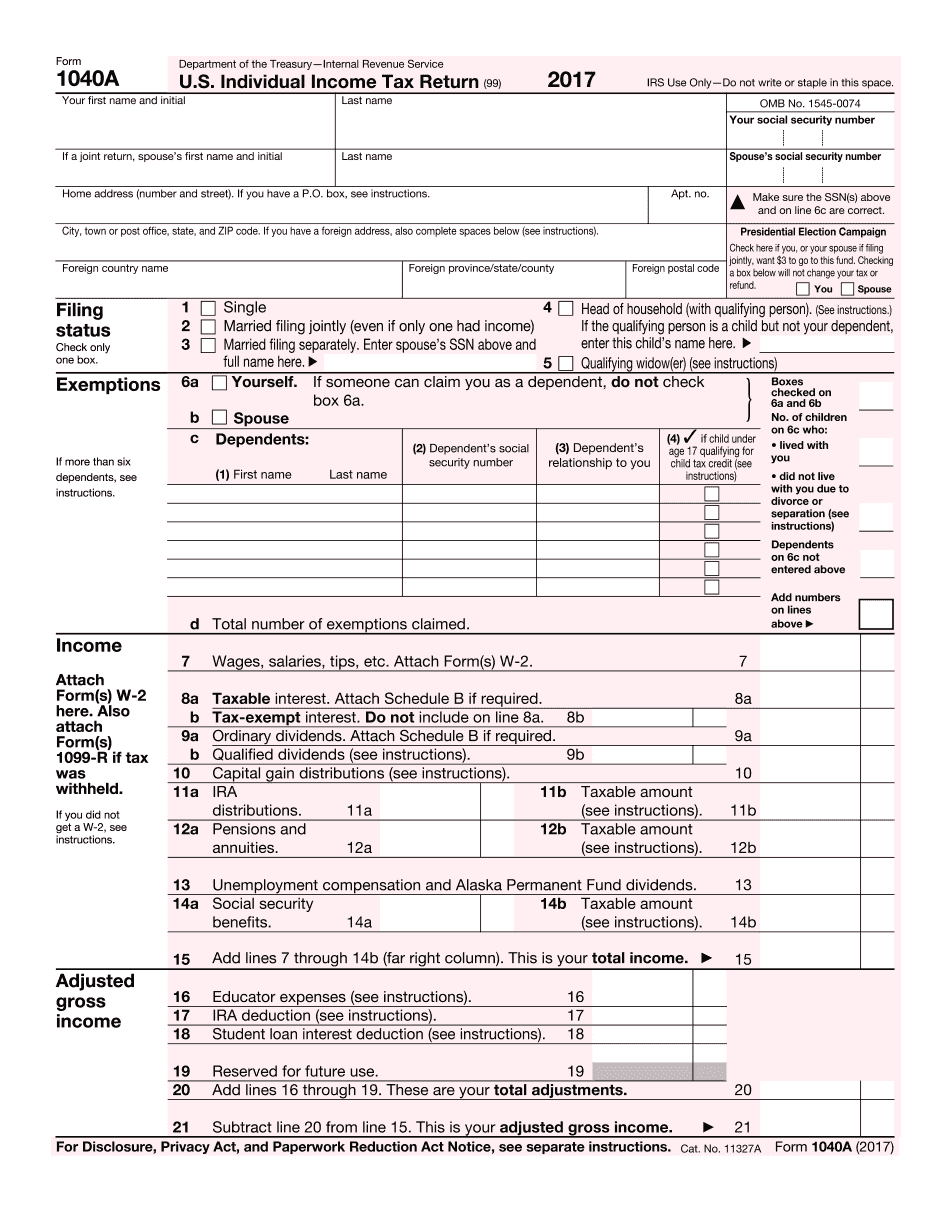

Printable Form What is IRS 1040a Simi Valley California: What You Should Know

The Form 1040A is based on two sections of the U.S. Internal Revenue code: Internal Revenue Code Section 1 (P.L. 90-351(a)) and Internal Revenue Code Section 1020 (P.L. 98-474). The Form. 1040. 2017. U.S. Individual Income Tax Return (99) must be filed by March 31, 2018. To determine which form is correct for you, select “Explanation of Instructions” and follow the instructions until a screen appears that looks like the one shown in the picture above. At the end of the instructions is “Form 1040. 2017.” Fill out page 1 of the form, then page 11. Do not complete the instructions. If you complete section I only and complete the instructions on page 4. The return is correct. Check page 32 and page 37 for all information and instructions that will apply to you. For additional tax advice about Schedule O, see Publication 541, Distributions from Retirement Plans. Forms and instructions, schedules, and publications that also appear in that publication are available from the publication's “Forms and Publications” section. To prepare your Form 1040, you should use the 2025 guidance if you were a U.S. taxpayer, and you received a notice that the 2025 deadline has passed. If you were a non-U.S. taxpayer and received a notice that the 2025 deadline has passed, you should use the guidance for the tax year before the 2025 deadline. See Instructions for Form 1040 and Publication 1040. Forms and instructions, schedules, and publications that do not appear in that publication are available from the publication's “Forms and Publication” section, under the “Additional Resources” heading, including “Forms & Publications” page. The 2025 guidance for Form 1041 requires you to take the following additional steps to complete your Form 1041: Print and complete and sign each Schedule H-1A or H-1B and Schedule H-2. (See the Instructions for Form 1041.) If you file Form 1040A and pay estimated tax, you must complete a Schedule H-2EZ. For the purpose of claiming Form 2555 for the estimated tax, complete a Schedule H-2GZ instead. If you are a U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form What is IRS 1040a Simi Valley California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form What is IRS 1040a Simi Valley California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form What is IRS 1040a Simi Valley California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form What is IRS 1040a Simi Valley California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.