Award-winning PDF software

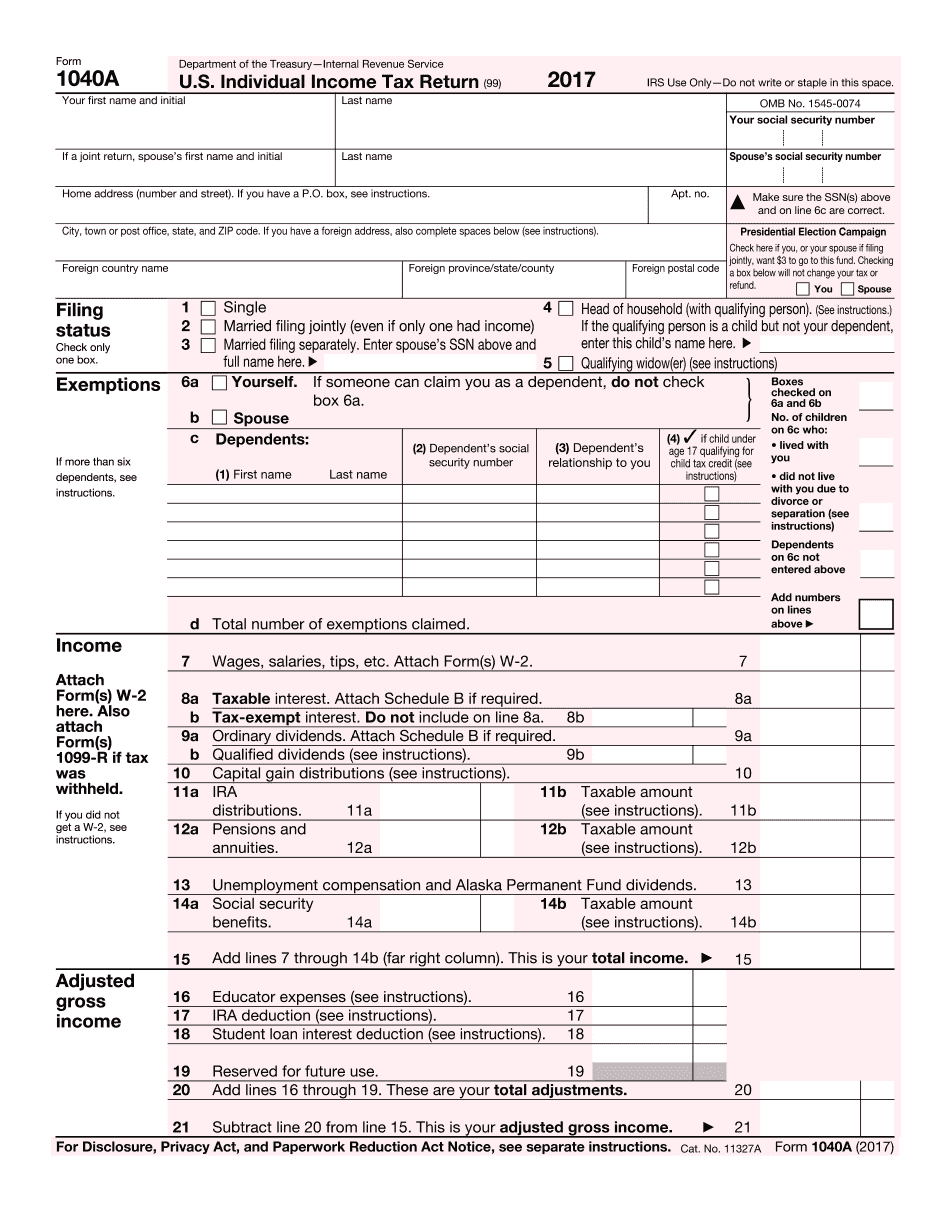

Form What is IRS 1040a for Santa Clara California: What You Should Know

The Form 1040A has more pages than the regular 1040, and lists additional columns of information about your adjusted gross income—such as the type of business you used to earn your income. In addition, both the 1040EZ and 1040A can be used to calculate your tax basis or capital gains on your investment in property. How to get free IRS tax preparer? The Free IRS Tax Preparer Program offers free tax preparation help for qualified Americans, for free. The Free IRS Tax Preparer Program (FO TPP) website is operated by the IRS. It is designed to help Americans, who are eligible to receive help with their federal income taxes, file their returns: to prepare free tax return forms using a free online tax software, for free; to pay a filing fee with a predesigned check or credit card payment method; or to find out about and register for FOTPP-related services including Free File and Free File Connect. The FO TPP website provides some simple links to IRS Free File locations and a searchable directory of Free File Centers around the country. The FO TPP also has a selection of free taxpayer services, such as free e-filing assistance, free Tax Counseling services, free Tax Assistance Center services, free tax forms, and free tax preparation assistance. Where can I obtain free tax preparation assistance? The Free IRS Tax Preparers Program operates in cooperation with the United States Department of the Treasury. The Free IRS Tax Preparers Program (FO TPP) website provides several links to FO TPP locations (including FOTPP-operated centers.) For help and information, you can call the nearest FOTPP-offices. How much it will cost to get free IRS tax preparation assistance? If you qualify for free IRS tax preparation assistance, there are two costs that can be covered directly. You can prepare a free tax return but need to pay the filing fee (60) directly to the United States Department of the Treasury with a predesigned check or credit card payment method, or your FOTPP-provided representative for a predesigned check or credit card payment. Or you can receive a fee-free tax preparation assistance from the IRS-trained volunteers. The amount, fee-free tax preparation assistance, and time-frames vary depending on your eligibility.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form What is IRS 1040a for Santa Clara California, keep away from glitches and furnish it inside a timely method:

How to complete a Form What is IRS 1040a for Santa Clara California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form What is IRS 1040a for Santa Clara California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form What is IRS 1040a for Santa Clara California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.