Award-winning PDF software

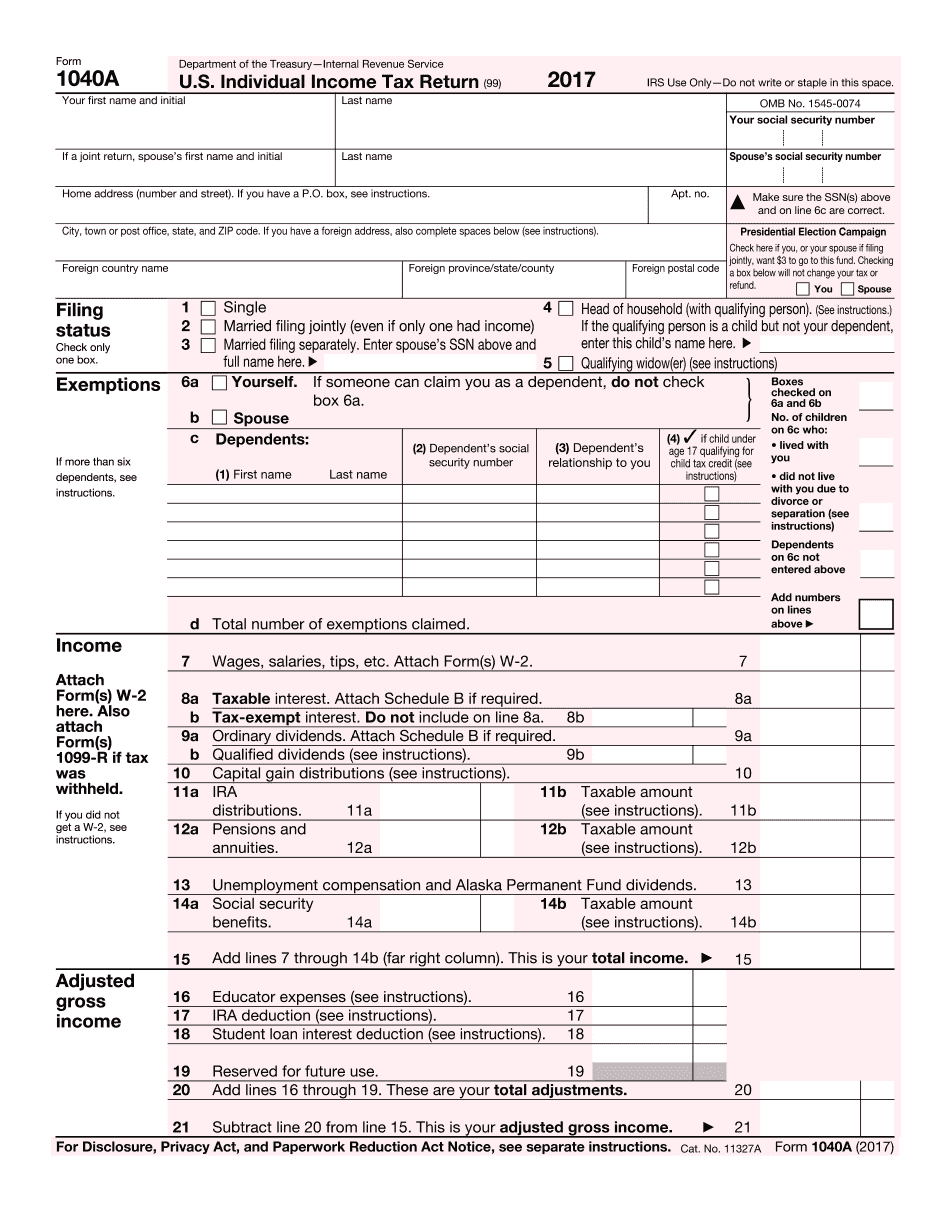

Printable Form What is IRS 1040a Rhode Island: What You Should Know

For a complete listing of the different deductions and penalties, including interest, see the 2025 Publication 519, Tax Guide for Small Business, by the IRS. Injured party. A party that is harmed by the preparation of a return. If you are an individual who must pay tax on a return, and you can't get help from an attorney because your tax situation is too complicated, you can use Form W-2G to tell the IRS that you are suing the employer for back taxes. The form provides you with a statement that states why you are suing, and where you can provide additional information. The form may be used to sue both the employer and the company that provided the wrong filing information on your tax return. The form also may be used by the IRS to collect up to 1,000 per person for tax on an itemized tax return under the authority of section 6012 of the Taxpayer Relief Act of 1997. Form W-2G — Form W-2G is a form that you must complete to get IRS protection under the IRS W-2G program. W-2G is available to all workers who made a business expense during the tax year, even if they were exempt. For more information on the W-2G program, go to IRS.gov/W2G and click on Register for W-2G. How to Cancel a Payment and Refund an Overpayment 2018 Form 8379 (Application to Reduce Payment Amount Due) — IRS Form 8379: Application to Reduce Payment Amount Due. 2025 Form 1095-A for Individuals Not Covered by the Social Security Act — IRS (1095-A) is for individuals who are not required to file a Social Security number on their tax return. The 1095-A is used to report various tax payments you receive, including Social Security benefits and Social Security tax withheld from your wages, as well as income from sources other than your Social Security income. The 2025 Form 1095-A is also available in paper form. If you file a paper tax return and your filing status is married filing jointly, or married filing separately, then you will need to provide information on this form. You can also contact the IRS directly at 1-800-TAX-FORM () to ask if you qualify. You must call your local IRS office to apply.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form What is IRS 1040a Rhode Island, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form What is IRS 1040a Rhode Island?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form What is IRS 1040a Rhode Island aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form What is IRS 1040a Rhode Island from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.