Form What Is IRS 1040a and Form 1040: Basics

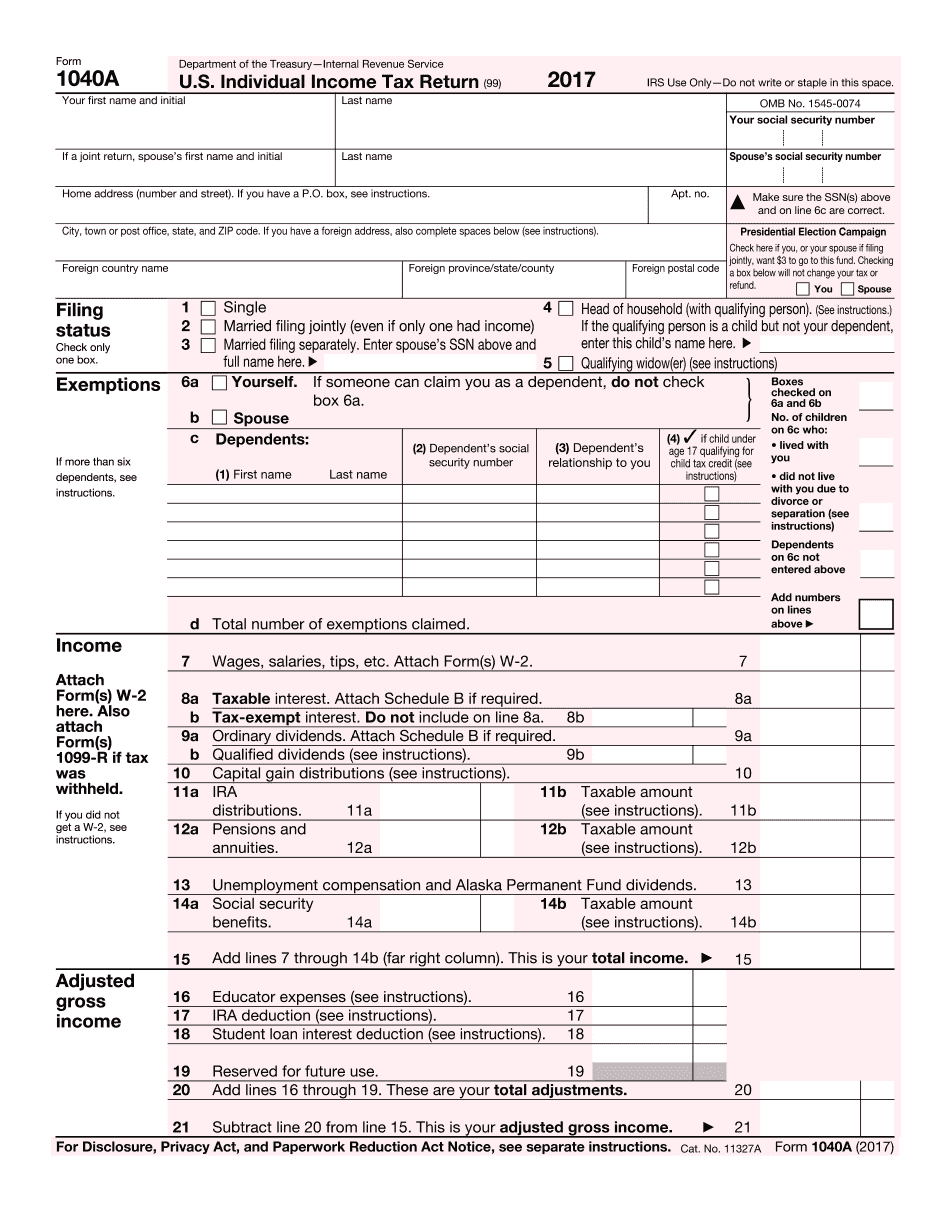

Form 1040-A: U.S. Individual Tax Return Definition

It had no specific list of item-specific code fields (the following table contains the ones used to classify taxable income) and no list of item-specific codes. All items that are tax-exempt, such as employer's contributions to social security and workers' compensation insurance, were itemized on Form 1040. A Form 1040-A is required and could be filed anytime after Jan. 1, 2017. If you were using Form 1040, it was likely done electronically as you probably used a computer or another electronic device to open a paper or PDF version. The Form 1040-A is a “simplified” version of current Form 1040. With the return filing system, it is possible to file the return electronically. Form 1040-A is a U.S. individual Income Tax Return Form 1040-A was filed by individuals (individuals are not required to use Form 1040, and individual income is not tax-exempt). The IRS also made it possible to file an Individual Income Tax Return electronically. The IRS used a number of specific item codes to classify the income and all items classified as taxable income were treated as taxable income. The IRS changed their use of the “specific items of itemization” on Form 1040-A and 1040-EZ each year following the 2010 tax year. This happened to be in 2011 as part of the “IRS Tax Intentions Act of 2011. It was also true before then. For the most part, item codes do not change between year to year. The exception is a number of items such as contributions to employer groups (EZ) and contributions to social security (EZ) that are not part of an employer's plan for social security or worker's compensation insurance (SSP) contributions. See the list of additional tax code-related fields that may be used on Form 1040-A. The Form 1040-EZ forms could only be filed after the 2013 tax year. Form 1040A and Form 1040EZ were available for use before. As a result of the Form 1040-EZ filing requirement, it is important that the same item codes appear on your tax return regardless of the year. To see if your returns will be ready electronically, call. The following table contains information about the item codes on Form 1040-A and 1040-EZ in

Form 1040: U.S. Individual Tax Return Definition, Types, and Use

A “tax return,” then, must be submitted to the IRS by an individual filing taxes for the year. This form is sent to the IRS by a taxpayer during the taxpayer's monthly tax response period, which is the time from the due date of filing the return to the payment of all the taxes due. The IRS uses its own rules when it determines which taxpayers fall within the monthly tax response period. Forms for Forms 1040 (Tax Returns) and 1040NR Use Form 1040, which can be mailed to the IRS or mailed to the address on the form. Form 1040 (Tax Returns) or Form 1040NR (NR1040NR) Form 1040, or Form 1040NR, can be sent to a tax processing facility in one of the following ways: The taxpayer can mail both forms directly to the IRS. Mail the form with an itemized statement of income and expenses to the address on the form. (See U.S. Filing Tips at page 7 for information on mailing the form in person.) Mail the form with an itemization statement of income and expenses to the address on the form. The taxpayer also can mail the form electronically to the address on the form using the IRS' Secure Access for E-File Users (SAFE) service. . The IRS can mail both forms directly to the taxpayer. Mail the form with an itemized statement of income and expenses to the address on the form. The taxpayer also can mail the form electronically to the address on the form within 3 or 45 days of the taxpayer's filing due date. To help taxpayers with complicated transactions, or who have questions about mailers for electronic filing, ask them about the Electronic Data Retrieval Service (EARS) (Form W-6). Forms for Forms 1120, 1040A and 1040NR Use Form 1120, which can be mailed to the IRS or mailed to the address on the form. Form 1120 (Tax Forms) In some cases, taxpayers may still want to complete one form for both the 1040 and the 1120 form that the taxpayers filed using a different address on the 1040. Form 1120 should not be used only if the taxpayer did not use a different address on the 1040 and the 1120 forms. When filing the 1040 and 1120 together, send both forms as a single PDF, not one single

Award-winning PDF software