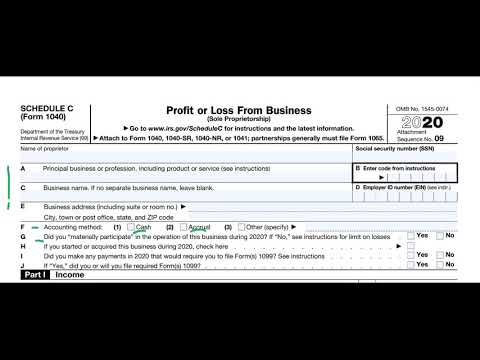

Hi everyone if you're a new business owner trying to better understand irs schedule c this video is for you if you're self-employed you report your income and business expense on schedule c of form 1040. you determine your profit on which you pay tax by subtracting your expenses from your income important note for tax year 2025 and later you will no longer use schedule c ez but instead use the schedule c schedule c basic information lines a through e are pretty easy background information principal business or profession business code business name employer id number and business address you can now obtain an employer identification number also known as ein instantly by applying online at www ir or by sending a completed form ss-4 application for employer identification number to the irs there are two topics in the basic information section that may need more explanation the accounting method your company uses and material participation in your business accounting method line f of the basic information section asks for the accounting method you use the two main methods report income are cash and accrual with the cash method you report income when you actually receive it and you deduct expenses when you actually pay them this rule has an exception if you charge an expense on a credit card you deduct this expense in the year charged even if you pay the charge in a later year with the accrual method you record revenue and expenses when the work or transaction is actually completed rather than when money changes hands say you must use the accrual method because you operate a clothing store you report income from a sale in the year that you make it even when you bill the customer or collect the money for...

Award-winning PDF software

Video instructions and help with filling out and completing Form What Is IRS 1040a vs. Form 1040 Schedule C-ez